How does coeo achieve a high level of trust from their customers while keeping up with the establishing digital payment, offered by their clients? Ben Calvert, Commercial Director, coeo UK, explains the approach.

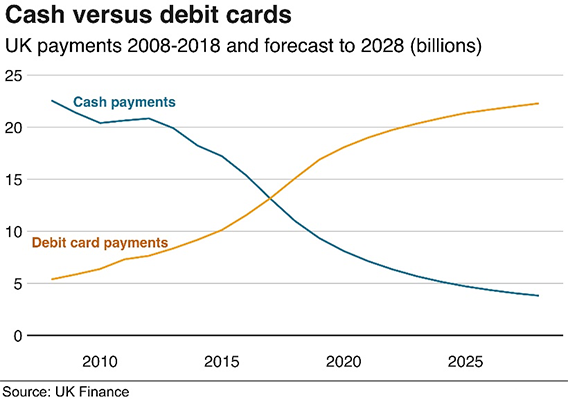

This transformation is closely tied to the emergence of new digital payment methods facilitated by digital wallets, initially pioneered by PayPal and further popularised by services like GPay and ApplePay. Leveraging the widespread use of smartphones, these technologies have effectively replaced physical wallets and transformed the landscape of financial transactions.

Even traditional payment methods, such as Standing Orders, have experienced a modern resurgence through innovations like Open Banking. This allows for seamless connectivity through smartphone banking apps, eliminating the need for cumbersome paperwork and traditional forms of transaction initiation.

For collections agencies, understanding and adapting to this digital payment landscape is crucial. As these agencies intervene in people's lives when they require a quick, frictionless, and stress-free approach to managing debt, offering customers the ability to pay on their terms using the most convenient methods is essential.

Just as intrusive engagement methods can deter customers, a complicated transaction process is equally off-putting. Therefore, embracing digital payments aligns with customer preferences, providing a familiar and efficient avenue for debt settlement.

In the UK, we have dedicated efforts to build a brand that resonates with customers. Our digital outreach has expanded through the utilisation of social media platforms such as TikTok, Instagram, and YouTube. Additionally, we have employed Search Engine Optimisation (SEO) strategies to enhance our visibility on Google, counteracting the prevalent misinformation about Debt Collection Agencies and clarifying their role in people's lives.

As a result of these initiatives, we have achieved a commendable Trustpilot score, indicating a high level of trust from our customers. Our engagement and resolution rates surpass those of our competitors, showcasing the effectiveness of our strategic digital approach.

Ben Calvert: Our business objectives align harmoniously with the needs of our key stakeholders, particularly customers, and this alignment is best elucidated by our overarching purpose: to assist customers in discovering the most suitable path forward for them.

This aligns seamlessly with the expectations of a contemporary, regulated financial services company.

Our business functions as a number of processes, each assigned an owner and subject to scrutiny by both 2nd and 3rd line compliance units. These processes undergo continuous improvement and are rigorously tested against the aforementioned principle. Consequently, we have established a customer-centric approach to debt collection.

This approach not only upholds but also enhances the client's brand, steering clear of the negative associations often linked to the practices of traditional debt collection methods.

Ben Calvert: In the future, digital transactions are poised to become even more seamless and pervasive, driven by technological advancements and evolving consumer preferences. With the continued rise of contactless payments, biometric authentication, and AI-driven personalisation, the digital transaction landscape is becoming increasingly user-friendly and efficient. Open banking initiatives further contribute to this transformation by providing consumers with more choices and integrated financial services.

As these technologies mature and interconnect, customers can expect a future where making digital payments is not only commonplace but also an intuitive and expected part of their everyday financial interactions.

The increasing integration and sophistication of digital payment systems contribute to a scenario where customers may start taking these advancements for granted. As technology evolves, the seamlessness of digital transactions becomes a standard expectation rather than a novelty. The convenience of contactless payments, the security of biometric authentication, and the personalised experiences facilitated by AI-driven services gradually become integral to consumers' financial routines.

Additionally, as regulatory frameworks adapt to these innovations, customers gain confidence in the reliability and safety of digital transactions. This normalisation is further fueled by the younger, tech-savvy generations growing up in an environment where digital payments are not just accepted but ingrained in their financial behaviors. As a result, the convenience and efficiency offered by digital transactions become an assumed part of the modern financial landscape, shaping expectations for future generations.

Ben Calvert: Our journey has already begun, and while many of our competitors are just now incorporating payment solutions that we embraced years ago, we remain committed to staying at the forefront. Our focus extends beyond current industry standards, as we strive to comprehend and leverage new payment methods that are not only innovative but also anticipated in the future.

This commitment aims to enhance the overall customer journey, aligning with our goal of providing the service that clients desire and anticipate from our company, Coeo. However, our success is not solely reliant on the adoption of advanced payment methods; it is anchored in continuous innovation driven by a clear customer-centric purpose.

Titelbild: © Mylene van Wijk